The Baseline Metric Every CEO and CMO Should Care About

Everyone knows you have to spend money to make money, but how much is too much to be spending on marketing? How do you develop a budget that yields maximum returns and revenue growth?

The answer is in the metrics.

There are several key metrics you should calculate in order to understand how your marketing and sales costs affect revenue, and how you can create budgets that optimize returns.

The first one will help you in calculating the others: Cost of Customer Acquisition (CAC).

What is CAC?

The Customer Acquisition Cost is a metric used to determine the total average cost your company spends to acquire a new customer.

How to calculate it:

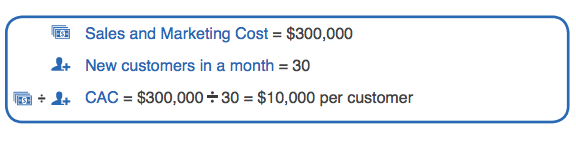

Take your total sales and marketing spend for a specific time period and divide by the number of new customers for that time period.

Sales and Marketing Cost = Program and advertising spend + salaries + commissions and bonuses + overhead in a month, quarter, or year

New Customers = Number of new customers in a month, quarter, or year

Formula: Sales and Marketing Cost ÷ New Customers = CAC

Here's an example:

Why CAC matters:

Your CAC calculation represents the amount your business is spending on acquiring each new customer. A low average CAC ensures your sales and marketing teams are onboarding customers with efficiency. If you see that number go up, it means you're spending more per customer and may want to investigate.

The other helpful thing about understanding your CAC is that you use it in other formulas to learn:

- How much marketing and sales contribute to each acquisition, respectively

- How efficient your marketing and sales teams are over time

- How long it takes for your customer to "pay off" their acquisition cost based on their lifetime value

For these topics and more, check out this free ebook: 6 Business Performance Metrics Every CEO & CMO Needs to Care About. It will brief you on 6 critical metrics (including CAC), explain how to calculate them, and discuss why monitoring them will help you create a more efficient, revenue-driving operation.

Editor's Note: This post was originally published in April 2015 and has been updated for accuracy and comprehensiveness.